Weekly Wealth Report

Issue 203, Weekly Wealth Newsletter: 28th July 2025 – 4th August 2025

(Weekly Wealth Newsletter and a Private Circulation from Creating Wealth Company)

Mr. Sathish Kumar

Curated by

Founder – Creating Wealth Company

Crorepathi Creator | Financial Consultant | Author | Speaker | Columnist | Youtuber

Phone – 9841058689

Mail – creatingwealthadvisory@gmail.com

Web – www.sathishspeaks.com

5 Costly Mistakes Every Investor To Avoid

Download This NewsLetter As A PDF

Last week a batchmate from Engineering reached out for help. He is a senior partner in an IT Firm, sharp business acumen, smarter career moves, good wealth but scattered investments, inconsistent returns, underperforming assets and the high fee he pays eroding his wealth.

In this edition of the Weekly Wealth Newsletter, I want to delve into these common mistakes that are wealth destroyers.

1. Chasing Returns – His Portfolio has many Thematic Funds and sector specific funds lacks diversification, has more timing risks ( Entry and Exit ) and its cyclical, not consistent performers.

Thematic funds tend to rise faster but also fall harder during market corrections. They behave like momentum bets, not core investments.

2. Overdiversification – His portfolio has 28 Number of Funds with 14 Asset Management Companies. More fund does not mean higher returns. It is overlapping.

He lost the benefit of choosing quality because your portfolio starts mimicking an index with extra costs. When you have too many investments, you don’t know which ones are driving performance. Tracking too many SIPs, statements, and holdings becomes timeconsuming.

3. Chasing Past Returns – Investing in the “best-performing fund” of last year thinking it will repeat. Markets are cyclical; past winners often underperform next. Different sectors perform at different times. A fund that did well last year may underperform in the current market

cycle.

4. Panic Selling during corrections – Selling investments when markets fall. Fear takes over during corrections or crashes. Every time he sold, Markets recovered with time; his fear-led selling turns paper losses into real losses.

Corrections are normal and healthy, not abnormal. After selling, you need to decide when to buy back, most investors miss the right moment

5. Ignoring Taxes when selling – Tax Cuts into Your Returns. He looked only at gross returns, not net returns after tax.

For example, selling equity funds or stocks before 1 year triggers ShortTerm Capital Gains (STCG) at 20% tax. Selling after 1 year triggers LongTerm Capital Gains (LTCG) tax at 12.5% (after ₹1.25 lakh exemption).

Successful Investment Strategy requires Regular Reviewing and Choosing Best Funds. Reach us @ 7810079946 for Your Portfolio Review and Best Performing Mutual Funds

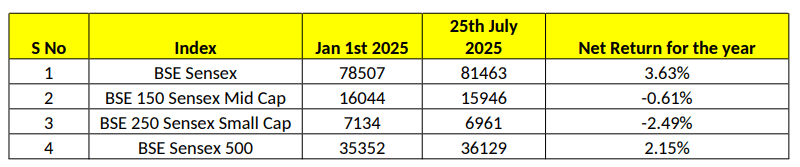

Weekly Market Pulse

Domestic equity markets declined for the third consecutive week, with keybenchmark indices BSE Sensex falling by 0.88% on Friday.

The fall was broad-based as the mid-cap segment and the small cap segment both closed the week in the red.

Domestic equity markets declined there are Earnings Impact & mixed Q1 Results, Valuation and Credit Concerns

Financials, IT, Auto & Energy led the decline: Bajaj Finance and Finserv fell by 5–6% due to MSME stress despite strong Q1 profits.

Only Nifty Pharma ended positive (+0.5%); other sectors posted declines up to 2%

Sun Pharma, SBI Life, Dr Reddy’s, and Cipla were among the rare gainers; INR weakens, hitting ~86.58/USD

FPIs remained cautious—shifted interest to IPOs and avoided secondary market trades, though net July inflows reached ₹3,839 crore

DIIs continued buying steadily, offsetting some of the FPI downtrend.

In coming week, U.S. Fed meeting, trade deadlines, and FPI behaviour are key catalysts.

Mutual Fund Corner

Edelweiss Multicap Fund

Edelweiss Multicap Fund that invests in stocks across Market Capitalisation and consistently explore opportunities in Large, Mid and Small Cap Space.

Why to Invest in Edelweiss Multicap Fund?

1. Fund follows the bottom-up approach for stock picking where investment decisions based on the specific sector criteria rather than Macro Economic Factors.

2. The fund objective is to construct a portfolio potential long term capital appreciation and can weather multiple market cycles

3. Diversification – By Investing across Market Capitalisation and Sectors the scheme diversify the risk and generate alpha

4. Flexibility allows the fund to be more responsive than reactive

5. Investors who are looking at long term opportunities can explore this fund without any bias

To invest in SIP & in Mutual Funds Click the link and start your investments instantly

( You can also call us @ 78100 79946 )

Mutual Fund Course

All you want to learn about Mutual Funds

Kickstart your Investment Journey of 2025 from here

What You will Learn:

1. A-Z of Mutual Funds

2. Master the Art of SIP’s

3. Build Wealth Like a Pro

4. Recorded session contains 8 Chapters in Tamil Language

5. Lifetime Access

Top 10 Mutual Fund Products

Is your Mutual Fund Portfolio giving less returns?

Rebalance your Portfolio with High Performing Mutual Funds

Power up your Portfolio with Top 10 Best performing Mutual Funds of 2025

Click the below link to purchase for Rs. 999/-

Stock Simplified Course

All you want to learn about Stock Market

Kickstart your Investment Journey of 2025 from here

Key Highlights:

1. Key entry and exit points of the stock market

2. 6-point filter to select a high-performing stock

3. Learn macro-economic trends in stock picking

This Week Media Publications

This Week @ Nanayam Vikatan!

How To Budget And Save More With Your Salary?

Quote for the Week!

“The stock market rewards patience, not panic.

Consistent growth beats short term speculation, every

single time.”

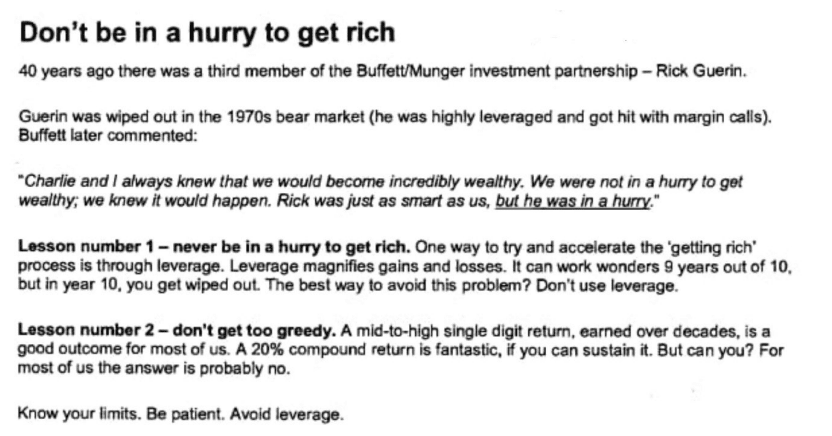

Wealth creation is a marathon, not a sprint.

Trying to get rich quickly often leads to mistakes. Real

wealth is built patiently, especially in stock market

investing.

My Book Publications

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.