Weekly Wealth Report

Issue 199, Weekly Wealth Newsletter: 30th June 2025 – 7th July 2025

(Weekly Wealth Newsletter and a Private Circulation from Creating Wealth Company)

Mr. Sathish Kumar

Curated by

Founder – Creating Wealth Company

Crorepathi Creator | Financial Consultant | Author | Speaker | Columnist | Youtuber

Phone – 9841058689

Mail – creatingwealthadvisory@gmail.com

Web – www.sathishspeaks.com

Can You Trust Social Media Advice for Your Investments?

Download this NewsLetter as a PDF

Social media is part of our daily lives today. Be it updating any life event or knowing any gossip about your favourite celebrity, Dinner Recipe or Investments advisory social media has all the solutions.

The Indian Stock Market has been on a roll over the past few years. This has given rise to several social media platforms sharing stock tips and market insights.

You may have come across many reels or posts showing the benefits of a particular investment option and influencing you to know more about them, right?

This is the power of social media today. So, does it really impact your investment portfolio?

Social media is a starting point for research for investment ideas, to understand the concept, nuances but not for the strategies as all the investment approach and strategies are tailor made for each individual requirement. Remember no two individuals has same requirement.

Recommendation is a responsible activity and it comes with an accountability. When it comes to social media the recommendations are one way, there will not be any reviews and no information on when to exit the product or investment.

Sometimes it is important to acknowledge that the recommendation comes from a person who might not have expertise, formal education, or qualification (Certifications) in Finance.

The ideas shared by them are often based on personal opinions rather than sound financial principles. Further, they may even have biases and conflict of interest, such as receiving a hefty compensation for promoting specific stocks and businesses. This can simply lead to biased recommendations.

Take social media as a place for your Research, Learning and to Analyse. When it comes to decision making, talk to an expert, devise a personalised investment strategy, to invest regularly and to review your investments periodically.

Call me if you want to talk or review about your existing investments or to start a new one to achieve your financial goals and dreams.

Successful Investment Strategy requires Regular Reviewing and Choosing Best Funds. Reach us @ 7810079946 for Your Portfolio Review and Best Performing Mutual Funds

Weekly Market Pulse

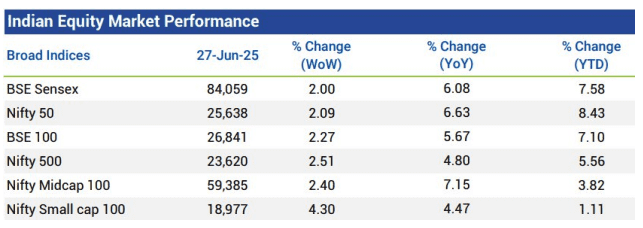

The Nifty 50, Nifty Midcap 150 and Nifty Small cap 250 upsurged by 2.09%, 2.61% and 4.29% respectively.

For the week ending June 27, 2025, stock markets performed strongly, with major indices nearing or surpassing record highs. A cease-fire between Israel and Iran helped calm global markets, reducing risk-off sentiment and supporting equity rallies

Foreign Institutional Investors (FIIs) pulled out Rs.2,480 crore over the week, while Domestic Institutional Investors (DIIs) stepped in with net buying of Rs.10,875.56 crore, providing crucial support.

Gold prices in India witnessed a sharp decline this week, reflecting global market uncertainty and easing geopolitical tensions.

For the week ending June 27, 2025, Major Sectors traded in the green midweek, driven by DII inflow, stable corporate earnings, positive global cues, easing geopolitical tensions, and expectations of favorable macroeconomic data.

Nifty Metal led the market with 4.81% gain compared to the previous week, driven by easing tariff concerns from the US, weaker DXY. It was followed by notable performances in Nifty Capital Markets (4.75%), Nifty Infrastructure (3.37%), Nifty Oil and Gas (3.25%), Nifty Financial Services ( 2.61%) and Nifty Energy (2.65%).

Mutual Fund Corner

Mirae Asset Balanced Advantage Fund

Mirae Balanced Advantage Fund will help investor to capitalise potential upside on Equities and limit the downside by dynamically managing the portfolio investment through Equity, Arbitrage, Debt and Money Market Instruments.

Why to Invest in Mirae Balanced Advantage Fund?

1. Fund follows the fundamental approach to assess equity market valuations at any point in time and ascertain the necessary desired net equity for fund

2. The fund therefore endeavours to provide an optimum equity market participation for Investor.

3. The fund attempts to provide a risk adjusted return experience while smoothening the volatility by actively managing the net equity position in the fund

4. The Net Equity and Arbitrage position will help the investor to get Equity Capital Gains advantage.

To invest in SIP & in Mutual Funds Click the link and start your investments instantly

( You can also call us @ 78100 79946 )

Mutual Fund Course

All you want to learn about Mutual Funds

Kickstart your Investment Journey of 2025 from here

What You will Learn:

1. A-Z of Mutual Funds

2. Master the Art of SIP’s

3. Build Wealth Like a Pro

4. Recorded session contains 8 Chapters in Tamil Language

5. Lifetime Access

Top 10 Mutual Fund Products

Is your Mutual Fund Portfolio giving less returns?

Rebalance your Portfolio with High Performing Mutual Funds

Power up your Portfolio with Top 10 Best performing Mutual Funds of 2025

Click the below link to purchase for Rs. 999/-

Stock Simplified Course

All you want to learn about Stock Market

Kickstart your Investment Journey of 2025 from here

Key Highlights:

1. Key entry and exit points of the stock market

2. 6-point filter to select a high-performing stock

3. Learn macro-economic trends in stock picking

This Week Media Publications

This Week @ Nanayam Vikatan!

How To Budget And Save More With Your Salary?

The Book I'm Reading For The Week

“The Almanack of Naval Ravikant” emphasizes building

wealth and happiness by focusing on specific knowledge,

leverage, and long-term thinking.

Eric Mentions about Ravikant views on Long term focus on

Wealth, Skills and Knowledge creation. Building Mental

Models for Business, Improving Productivity, Scaling up,

Investing and Much More

I was just fascinated and attracted by his personality,

thoughts and wisdom.

My Book Publications

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.