Weekly Wealth Report

Issue 194, Weekly

Wealth Newsletter: 26th May 2025 – 2nd June 2025

(Weekly Wealth Newsletter and a Private Circulation from Creating Wealth Company)

Curated by

Mr. Sathish Kumar

Founder – Creating Wealth Company

Crorepathi Creator | Financial Consultant | Author | Speaker | Columnist | Youtuber

Phone – 9841058689

Mail – creatingwealthadvisory@gmail.com

Web – www.sathishspeaks.com

Sensex Can Hit 1,00,000? Morgan Stanley Report!

Download this NewsLetter as a PDF

The recent correction in the Indian stock market from the September 2024 highs presents a compelling opportunity to invest in the country’s long-term growth story, according to global brokerage Morgan Stanley. While the firm has revised its base case Sensex target for June 2026, it also predicts the index reaching the 1,00,000 mark under its bull case scenario.

In its latest outlook, Morgan Stanley has set the Sensex base case target of 89,000 by June 2026, reflecting an 8% upside from current levels. However, under its bull case scenario, which it assigns a 30% probability.

This assumes sustained improvements in India’s macroeconomic stability through fiscal consolidation, rising private sector investment, and a positive real growth-real interest rate gap. A stable domestic growth outlook, absence of a US recession, and moderate oil prices are also factored into the forecast.

In the bull case, Morgan Stanley envisions a more favourable macro and policy environment, leading to the Sensex reaching 1,00,000 by June 2026.

Key assumptions include crude oil prices remaining consistently below $65 per barrel, allowing for further monetary easing by the RBI, and a resolution of global trade tensions through reversals in tariff policies. Additionally, unexpected policy reforms—such as GST rate cuts and progress on agricultural reforms—could provide further tailwinds.

The report highlights that the current environment is likely to be a “stock pickers’ market”, diverging from the macro-driven rallies observed since the onset of the Covid-19 pandemic.

The brokerage is overweight on Financials, Consumer Discretionary, and Industrials, while maintaining an underweight stance on Energy, Materials, Utilities, and Healthcare.

However, What Can Go Wrong With Equities?

Morgan Stanley assigns a 20% probability to its bear case, in which the Sensex drops to 70,000 by June 2026.

This scenario assumes a sharp rise in crude oil prices above $100 per barrel, leading to monetary tightening by the RBI to maintain macroeconomic stability. It also factors in a significant global growth slowdown, including a recession in the US. Under these conditions, earnings growth is expected to moderate to 15% annually through FY28, with a noticeable deceleration in FY26. Equity valuations are also likely to compress in response to deteriorating macro fundamentals.

We recommend to increase your SIP and to Stay Invested for Long Term

Successful investment strategy requires regular reviewing and

investor should buy funds at lower levels you can always reach us

@ 78100 79946 for your portfolio review and rebalance

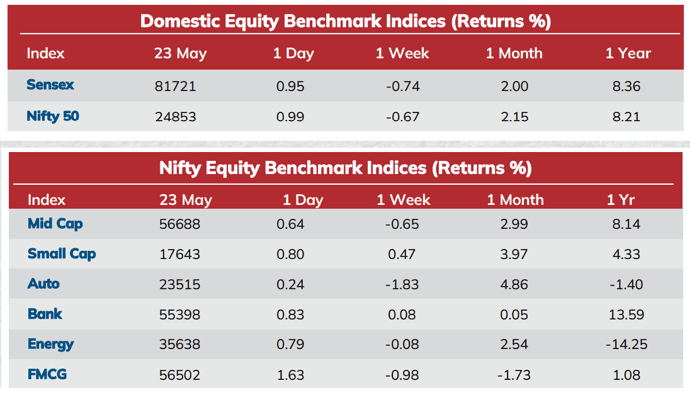

Weekly Market Pulse

Indian equity benchmarks ended higher on Friday, supported by gains in FMCG stocks and easing US Treasury yields that reduced concerns about a potential US Federal Reserve rate hike.

India has overtaken Japan to become the world’s fourth-largest economy, NITI Aayog Chief Executive Officer (CEO) BVR Subrahmanyam said, citing data by the International Monetary Fund at a press conference of the 10th NITI Aayog Governing Council Meeting on Viksit Rajya for Viksit Bharat 2047.

Domestic equity markets rose after witnessing a fall in the previous week as key benchmark indices BSE Sensex and Nifty 50 rose 8.36% and 8.21%, respectively for the Year 2025. The rally was broad-based as the mid-cap segment and the small-cap segment both closed the week in the green.

Domestic equity markets rallied as sentiment improved following an agreement between India and Pakistan to cease all military actions on land, air, and sea, effective immediately from May 10, 2025 and improved trade sentiment with US and China.

Mutual Fund Corner

Invesco Large Cap Fund

Given the current volatility in the markets, large cap stocks are appearing attractive thanks to their resilience and relative stability. Invesco India Large Cap Fund invests in companies that can steer growth through all market conditions and potentially deliver consistent results and stay ahead in the long term.

Why to Invest in Invesco Large Cap Fund?

1. Diversified Portfolio – Atleast 80% of Net Assets will be Invested in Large Cap Companies

2. Seek Opportunities from Growth – Predominantly invests in growth stocks with exposure of few value opportunities

3. Alpha Generation – This fund aims to generate returns from Stock Selection and Sector Allocation

4. Potential ROE – Seeks to Invest in companies with potential Return on Equity (ROE – Industry Leading Companies)

To invest in SIP & in Mutual Funds Click the link and start your investments instantly

( You can also call us @ 78100 79946 )

Mutual Fund Course

All you want to learn about Mutual Funds

Kickstart your Investment Journey of 2025 from here

What You will Learn:

1. A-Z of Mutual Funds

2. Master the Art of SIP’s

3. Build Wealth Like a Pro

4. Recorded session contains 8 Chapters in Tamil Language

5. Lifetime Access

My First 1 Crore Club

Still Wondering how a salaried person/professionals can make 1cr?

Why do you have to join this Community?

• Having money but still doesn’t know how & where to invest?

• Selecting wrong Stocks?

• Selecting wrong mutual funds?

• Invested in all possible ways still money haven’t doubled?

Join our First 1cr Club Webinar by payingjust 499/-

Stock Simplified Course

All you want to learn about Stock Market

Kickstart your Investment Journey of 2025 from here

Key Highlights:

1. Key entry and exit points of the stock market

2. 6-point filter to select a high-performing stock

3. Learn macro-economic trends in stock picking

This Week Media Publications

This Week @ Nanayam Vikatan!

What Are The Best Alternatives To Fixed Deposits?

My Book Publications

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.