- India Size Shifts – A Top 5 Economy Now India breaking into top 5 economies in the World.

- Likely to be in top 3 in next 5 years. From $3.7 tn in 2023, Indian economy is likely to reach $5.9 tn by 2028 (IMF), with growth averaging 6.3% from 2023- 2028. India’s economy continues to be one of the faster growing major economies

- FY24 inflation eased to 5.4%-5.5% range (FY23 : 6.7% y/y) – with core likely ~4.5%.

- FY25 (P) inflation expected to moderate further to 5% mark

- Working population group is 694 Mn (ages 20-55), making it the second largest labour force in the world, only after China’s.

- Median age below 30 years makes India one of the youngest population in the world

- Sustained levels of elevated GST collections suggest improving compliance, rising consumption demand and favorable economic outlook.

Call us @ 6379518807 to Invest in Mutual Funds and Stock Market

Take advantage and grow with the Indian Stock market

Weekly Market Update

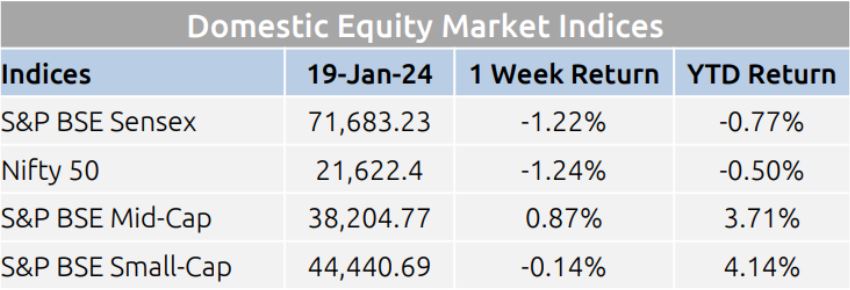

- Domestic equity markets fell after witnessing a rise in the previous week as key benchmark indices S&P BSE Sensex and Nifty 50 fell 1.22% and 1.24% respectively

- The small-cap segment also closed in red, however, the mid-cap segment witnessed gains.

- Domestic equity markets started the week with healthy gains and reached a fresh high as sentiments underpinned by the better-than- expected quarterly earning updates from some of the index heavy- weights along with hope for early rate cut by the U.S. Fed and the European Central Bank.

- On the BSE sectoral front, S&P BSE Oil & Gas rose 4.19% due to surge in state-run oil companies which was fueled by capital spending of Rs. 89,000 crore that represented 84% of capex target of FY24, in the first nine months of the current fiscal year to improve new production and distribution facilities.

- S&P BSE Bankex fell 3.65% as outlook soured for banking sector following the Q3FY24 result of the country’s biggest private sector lender, HDFC Bank Results.

Mutual Fund Corner

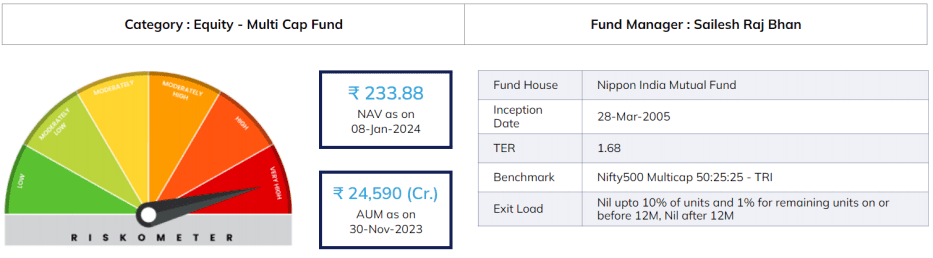

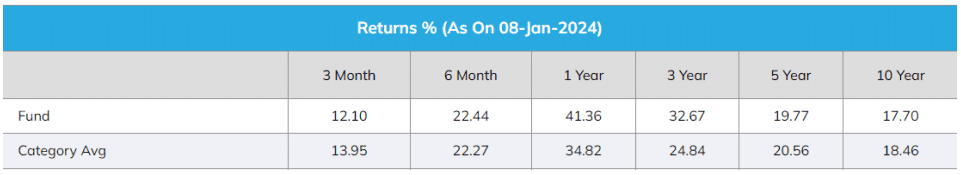

Nippon Multi Cap Fund

- The primary investment objective of the scheme is to seek to generate capital appreciation & provide long term growth opportunities by investing in a portfolio constituted of equity securities & Equity related securities and the secondary objective is to generate consistent returns by investing in debt and money market securities.

- The fund has 98.37% investment in domestic equities of which 36% is in Large Cap stocks, 21.97% is in Mid Cap stocks, 23.75% in Small Cap stocks.

- To invest in SIP & in Mutual Funds Click the link and start your investments instantly

http://www.assetplus.in/partner/sathishkumar

Stock of the Week

Persistent Systems

CMP – 8639

Target – 10,500 ( In 6 – 12 Months Time Frame)

- CEAT, established in 1958, is one of the largest tyre manufacturers and one of the fastest-growing tyre companies in India. CEAT became a part of the RPG Group in 1982. It is amongst the Top 25 best workplaces in Manufacturing by GPTW for 2022

- With a growth in Net Profit of 38.03%, the company declared Outstanding results in Sep 23

- The company has declared positive results for the last 4 consecutive quarters

- ROCE(HY) Highest at 16.58 %

- OPERATING PROFIT TO INTEREST(Q) Highest at 6.36 times

- With ROCE of 16.7, it has a Very Attractive valuation with a 2.4

Enterprise value to Capital Employed - High Institutional Holdings at 34.29%

For your Equity recommendation – open a De Mat account with Angel Broking with this link

This week Media Publications

This News letter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689 You can also connect with us investments@sathishspeaks.com Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme related documents carefully. Past performance of the mutual fund is not necessarily indicative for future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purpose only and contains information, opinion, material obtained from reliable sources and every effort has been made to avoid errors and omissions and is not to be construed as an advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means are prohibited.