Weekly Wealth Report

Issue 200, Weekly Wealth Newsletter: 7th July 2025 – 14th July 2025

(Weekly Wealth Newsletter and a Private Circulation from Creating Wealth Company)

Mr. Sathish Kumar

Curated by

Founder – Creating Wealth Company

Crorepathi Creator | Financial Consultant | Author | Speaker | Columnist | Youtuber

Phone – 9841058689

Mail – creatingwealthadvisory@gmail.com

Web – www.sathishspeaks.com

Dear Investors & Readers

I'm Very Excited & Happy To Present The 200th Edition Of This Newsletter

4 Years back, I envisaged to present Newsletter on Equity and Financial Markets with Indian and Global Perspectives on a weekly basis and hence this Weekly Wealth Letter.

Our dream to make investing simpler, profitable, and accessible to everyone and this is one simple step to educate Investors and make investing an easy process

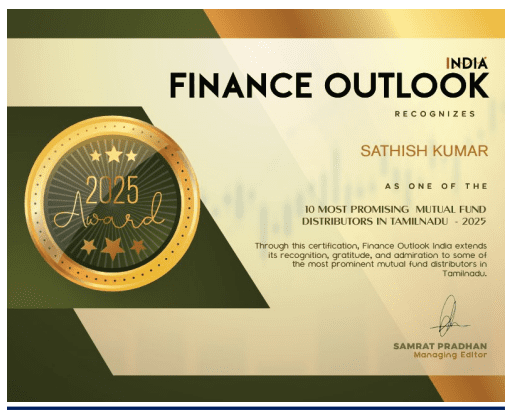

I’m truly honoured and humbled to share that Finance Outlook have been recognized us as the

“Top 10 Professional in Mutual Fund Distribution”

This achievement is not just mine alone. It belongs to every client

who trusted us and every challenge that shaped us.

Awards come and go, but the real reward is the opportunity to make a

difference in people’s lives every single day through our work

Thank you very much for being a part of this journey

Magazine Link

Has FII’s Turned Net Buyers?

Download this NewsLetter as a PDF

Foreign investors put in Rs 14,590 crore in the equity market in June, marking the third straight month of investment, supported by improving global liquidity conditions, easing geopolitical tensions, and rate cut by RBI.

In the beginning of 2025, FPI flows are expected to remain choppy on account of Tariff’s deadlines, US Data and muted Q3 results in Jan 2025.

President Trump’s administration confirm that the deadline has been extended to 1st Aug 2025, which is also a positive news for the Market.

With India’s rise to the position of the fourth largest economy and Indian Growth Story makes a compulsive investment zone for FII’s.

Successful Investment Strategy requires Regular Reviewing and Choosing Best Funds. Reach us @ 7810079946 for Your Portfolio Review and Best Performing Mutual Funds

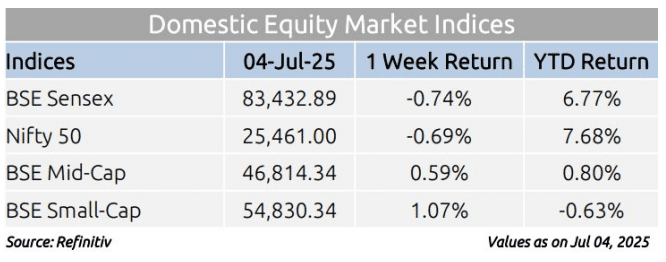

Weekly Market Pulse

key benchmark indices BSE Sensex and Nifty 50 falling by 0.74% and 0.69%, respectively.

However, the mid-cap segment and the small-cap segment both closed the week in the green.

Domestic equity markets declined as investor caution grew ahead of the July 8, U.S. reciprocal tariff deadline, amid uncertainty over trade negotiations and the nearing end of the 90-day tariff pause.

Strong U.S. jobs data for June 2025 further dampened hopes of a near-term rate cut by the U.S. Fed, while concerns over the upcoming Q1 FY26 earnings season of domestic companies also weighed on sentiment.

On the BSE sectoral front, BSE Realty declined by 2.20% amid concerns over rising unsold housing inventory.

According to a report by a leading domestic property consultancy, approx. 5.59 lakh residential units remain unsold across seven major cities.

BSE Healthcare rose by 2%, supported by strong gains in export-oriented pharmaceutical stocks.

Mutual Fund Corner

Edelweiss Multicap Fund

Edelweiss Multicap Fund that invests in stocks across Market Capitalisation and consistently explore opportunities in Large, Mid and Small Cap Space.

Why to Invest in Edelweiss Multicap Fund?

1. Fund follows the bottom-up approach for stock picking where investment decisions based on the specific sector criteria rather than Macro Economic Factors.

2. The fund objective is to construct a portfolio potential long term capital appreciation and can weather multiple market cycles

3. Diversification – By Investing across Market Capitalisation and Sectors the scheme diversify the risk and generate alpha

4. Flexibility allows the fund to be more responsive than reactive

5. Investors who are looking at long term opportunities can explore this fund without any bias

To invest in SIP & in Mutual Funds Click the link and start your investments instantly

( You can also call us @ 78100 79946 )

Mutual Fund Course

All you want to learn about Mutual Funds

Kickstart your Investment Journey of 2025 from here

What You will Learn:

1. A-Z of Mutual Funds

2. Master the Art of SIP’s

3. Build Wealth Like a Pro

4. Recorded session contains 8 Chapters in Tamil Language

5. Lifetime Access

Top 10 Mutual Fund Products

Is your Mutual Fund Portfolio giving less returns?

Rebalance your Portfolio with High Performing Mutual Funds

Power up your Portfolio with Top 10 Best performing Mutual Funds of 2025

Click the below link to purchase for Rs. 999/-

Stock Simplified Course

All you want to learn about Stock Market

Kickstart your Investment Journey of 2025 from here

Key Highlights:

1. Key entry and exit points of the stock market

2. 6-point filter to select a high-performing stock

3. Learn macro-economic trends in stock picking

This Week Media Publications

This Week @ Nanayam Vikatan!

How To Budget And Save More With Your Salary?

The Book I'm Reading For The Week

“The Almanack of Naval Ravikant” emphasizes building

wealth and happiness by focusing on specific knowledge,

leverage, and long-term thinking.

Eric Mentions about Ravikant views on Long term focus on

Wealth, Skills and Knowledge creation. Building Mental

Models for Business, Improving Productivity, Scaling up,

Investing and Much More

I was just fascinated and attracted by his personality,

thoughts and wisdom.

My Book Publications

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.