Weekly Wealth Report

Issue 201, Weekly Wealth Newsletter: 14th July 2025 – 21st July 2025

(Weekly Wealth Newsletter and a Private Circulation from Creating Wealth Company)

Mr. Sathish Kumar

Curated by

Founder – Creating Wealth Company

Crorepathi Creator | Financial Consultant | Author | Speaker | Columnist | Youtuber

Phone – 9841058689

Mail – creatingwealthadvisory@gmail.com

Web – www.sathishspeaks.com

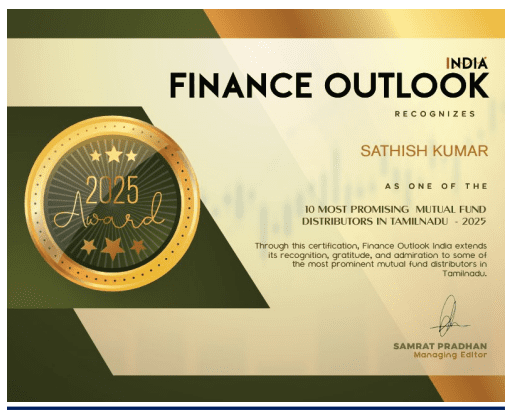

I’m truly honoured and humbled to share that Finance Outlook have been recognized us as the

“Top 10 Professional in Mutual Fund Distribution”

This achievement is not just mine alone. It belongs to every client

who trusted us and every challenge that shaped us.

Awards come and go, but the real reward is the opportunity to make a

difference in people’s lives every single day through our work

Thank you very much for being a part of this journey

Magazine Link

Is Sensex Resilient At 83,000?

Download This NewsLetter As A PDF

Domestic markets declined for second straight week, factors like concerns on US Fiscal Deficit, US Growth, Fed delaying rate cuts and US Trade Tariff’s deadlines are adding pressure to the markets.

Indian Markets also underperformed because of concern on rising valuations and caught in red amid profit booking after massive gains in last month.

While global environment is becoming more challenging with increased trade barriers, policy uncertainty, high inflation etc. India’s remains resilient with steady growth and low inflation.

A softer dollar with comfortable inflation outlook has given more window for EM Central banks to cut interest rates and spur liquidity. Historically, weak dollar index has supported Indian equities.

India is rising strategically and steadily with solid infra build up in the nation, rising digitization & financialization, nation emerging as a favourable manufacturing destination etc. have all contributed to India’s rising share in world exports.

The large-scale expansion in core infrastructure is likely to create a 3.2x multiplier effect on the economy while also attracting increased private & foreign capital inflows.

Alongside expanding its global footprint, India remains firmly focused on domestic consumption supported by rising income levels & evolving consumer preferences

Rising per capita income, high saving capacity, lowering trends of inflation and tax sops in the budget are likely to improve household balance sheets.

Shift in the nation’s income distribution is expected to drive stronger and premium-oriented consumer demand

The domestic demand too remains solid given the low inflationary pressures, rising disposable income and a shift in consumer preferences

While India remains relatively resilient, what are the watchful concerns for current stock market

1. Valuations although have come off from its Sep-24 highs but continue to remain high in the mid & small cap space

2. Equity Valuations Index suggest that market valuations are not cheap and continue to remain in neutral zone

3. DII flows remain strong but have moderated from its highs. FPI flows though recovered but global risks could stall the trend thereby impacting the market sentiments

Your portfolio needs to match the nation’s growth! Stay invested

Successful Investment Strategy requires Regular Reviewing and Choosing Best Funds. Reach us @ 7810079946 for Your Portfolio Review and Best Performing Mutual Funds

Weekly Market Pulse

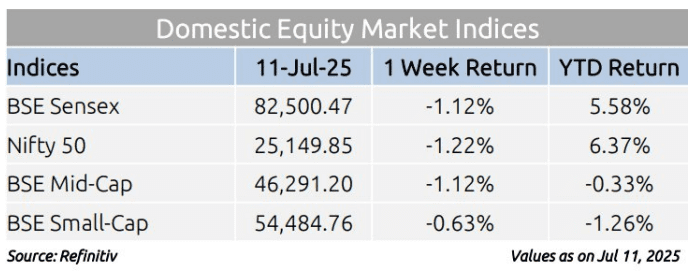

Domestic equity markets declined for the second consecutive week, with key benchmark indices BSE Sensex and Nifty 50 falling by 1.12% and 1.22%, respectively.

The fall was broad-based as the mid-cap segment and the small cap segment both closed the week in the red.

Domestic equity markets declined as escalating tariff tensions and fresh threats from the U.S. President dampened hopes for a swift trade resolution, raising fears of inflation and a global slowdown.

Sentiment was further weighed down by a disappointing start to the earnings season, with a major Indian IT firm reporting weaker-than-expected Q1 FY26 results.

On the BSE sectoral front, BSE IT index declined by 3.36% as tech stocks faced multiple headwinds, including subdued earnings from major IT company like Tata Consultancy Services in Q1FY26 and rising global trade tensions.

BSE Metal fell 2% after the U.S. President announced a 50% tariff on copper imports, intensifying trade tensions and building on earlier tariffs already imposed on steel and aluminium.

Mutual Fund Corner

Edelweiss Multicap Fund

Edelweiss Multicap Fund that invests in stocks across Market Capitalisation and consistently explore opportunities in Large, Mid and Small Cap Space.

Why to Invest in Edelweiss Multicap Fund?

1. Fund follows the bottom-up approach for stock picking where investment decisions based on the specific sector criteria rather than Macro Economic Factors.

2. The fund objective is to construct a portfolio potential long term capital appreciation and can weather multiple market cycles

3. Diversification – By Investing across Market Capitalisation and Sectors the scheme diversify the risk and generate alpha

4. Flexibility allows the fund to be more responsive than reactive

5. Investors who are looking at long term opportunities can explore this fund without any bias

To invest in SIP & in Mutual Funds Click the link and start your investments instantly

( You can also call us @ 78100 79946 )

Mutual Fund Course

All you want to learn about Mutual Funds

Kickstart your Investment Journey of 2025 from here

What You will Learn:

1. A-Z of Mutual Funds

2. Master the Art of SIP’s

3. Build Wealth Like a Pro

4. Recorded session contains 8 Chapters in Tamil Language

5. Lifetime Access

Top 10 Mutual Fund Products

Is your Mutual Fund Portfolio giving less returns?

Rebalance your Portfolio with High Performing Mutual Funds

Power up your Portfolio with Top 10 Best performing Mutual Funds of 2025

Click the below link to purchase for Rs. 999/-

Stock Simplified Course

All you want to learn about Stock Market

Kickstart your Investment Journey of 2025 from here

Key Highlights:

1. Key entry and exit points of the stock market

2. 6-point filter to select a high-performing stock

3. Learn macro-economic trends in stock picking

This Week Media Publications

This Week @ Nanayam Vikatan!

How To Budget And Save More With Your Salary?

Quote for the Week!

“The stock market rewards patience, not panic. Consistent growth beats short term speculation, every single time.”

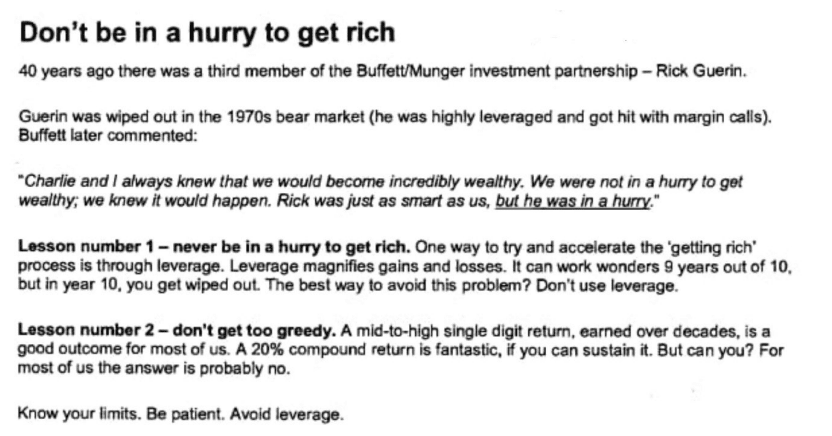

Wealth creation is a marathon, not a sprint. Trying to get rich quickly often leads to mistakes. Real wealth is built patiently, especially in stock market investing.

My Book Publications

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.