Issue 130, Weekly Wealth Newsletter: 19th Feb 2024 – 26th Feb 2024

157 Equity mutual fund schemes that have completed seven years in the market and found that 119 equity schemes have failed to beat their respective benchmarks. In other words, 38 equity schemes have managed to outperform their respective benchmarks in a seven-year horizon.

These 119 equity schemes were from midcap, large & midcap, focused fund, large cap, flexi cap, ELSS, value fund, small cap fund, and contra fund categories.

It is very important to Review your Mutual Fund Portfolio for every 4 Months.

When was the last time you reviewed your portfolio with respect to Fund Performance and your Goal Alignment?

Call us @ 63795 18807 to Review your Mutual Fund Portfolio

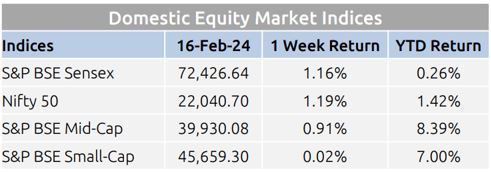

Weekly Market Update

- Domestic equity markets rose during the week after witnessing a fall in the previous week as key benchmark indices S&P BSE Sensex and Nifty 50 rose 1.16% and 1.19% respectively

- The rally in the market was broad-based as the mid-cap segment and the small-cap segment also closed the week in green.

- Domestic equity markets rose following the ease in domestic retail inflation data of Jan 2024, which remained under the RBI’s upper tolerance level for fifth consecutive time.

- Sentiments were improved following the lower than-expected inflation data from U.K. of Jan 2024.

- Gains were extended following the weaker U.S. retail sales data along with below than expected industrial production data of Jan 2024 that raised the expectations of rate cuts by the U.S. Fed in near future.

- On the BSE sectoral front, S&P BSE AUTO rose 4.97% following the encouraging sales data released by the Society of Indian Automobile Manufacturers that showed Passenger Vehicles, Three Wheelers and Two Wheelers posted growth of 14%, 9% and 26% in Jan 2024 compared to Jan 2023, respectively.

- S&P BSE Oil & Gas rose 3.15% as analysts expected healthy marketing margins of oil marketing companies in FY25 due to possibility of increase in prices by these companies after the General Election 2024.

Mutual Fund Corner

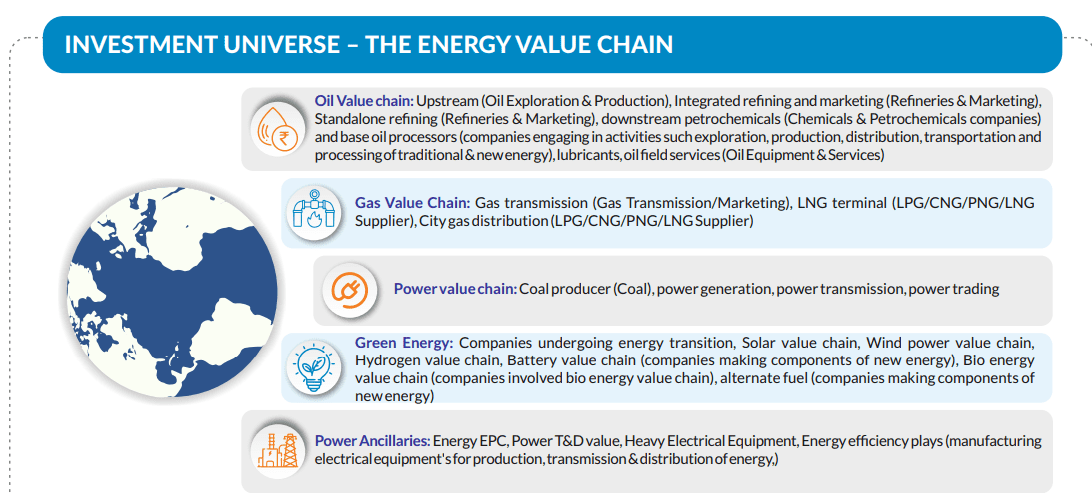

SBI Energy Opportunities Fund - NFO

India's energy sector is on a trajectory towards self-sufficiency, aligning with the Aatmanirbhar Bharat vision. Positioned as one of the largest and fastest-growing energy markets globally, the country is witnessing a shift from conventional combustion to electrification.

Projections indicate a robust 6.4% CAGR in energy consumption, excluding coal and oil, until 2050. With a natural advantage in green energy, India is expected to transition from an energy-deficient state to being energy self-sufficient.

Stock of the Week

ICICI Bank

CMP – 1022

Target – 1200 ( In 6 – 12 Months Time Frame)

For your Equity recommendation – open a De Mat account with Angel Broking with this link

This week Media Publications

At this week Nanayam Vikatan – Business Vs Mutual Funds – Where to Invest your Money? Pick up your copy, magazine is at your nearest stands.

Middle Class to Million Dollar Book

To Buy my Untold Wealth Secret Book from Flipkart

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.