Weekly Wealth Report

Issue 204, Weekly Wealth Newsletter: 4th August 2025 – 11th August 2025

(Weekly Wealth Newsletter and a Private Circulation from Creating Wealth Company)

Mr. Sathish Kumar

Curated by

Founder – Creating Wealth Company

Crorepathi Creator | Financial Consultant | Author | Speaker | Columnist | Youtuber

Phone – 9841058689

Mail – creatingwealthadvisory@gmail.com

Web – www.sathishspeaks.com

Trump’s Tariffs, Tension & Valuations In Stock Market

Download This NewsLetter As A PDF

We have had a busy week in Stock Market because of Trump’s Tariff’s, Corporate Results,

FII Outflows, Global Trade Wards and Valuations.

Indian Equities navigated a volatile first half of 2025. January and February witnessed corrections driven by global tariff uncertainty and geopolitical concerns with the Mid and Small cap indices bearing the brunt.

However, markets rebounded sharply as the markets realised local strength driven by strong domestic macroeconomic fundamentals, a very supportive monetary policy and prudent fiscal management.

Indian Stock Markets has not crashed and it is resilient even after US imposed steep 25% tariffs on Indian imports, the highest in Asia ( Vietnam (20%), Indonesia and the Philippines,(19%) each ).

Analysts predict potential tariffs reduction through negotiations is possible with US trade delegation. Even as the government has been guarded in its response to US President Donald Trump’s tariffs, an official has sought to paint a rather optimistic picture and said that the impact could be limited to

just 0.2 percent of the GDP.

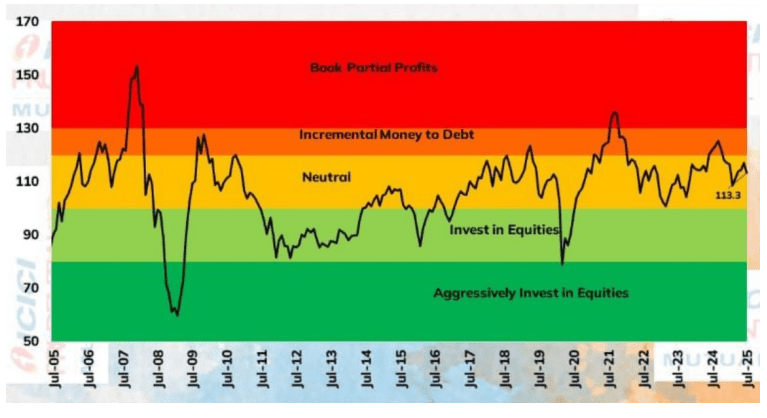

VALUATIONS HAVE UNDERGONE A CORRECTION

Nifty is barely changed over the past one year while earnings have expanded by 8%. This points to a significant valuation correction over past one year. In a period when interest rates have declined and liquidity has improved.

FY25 GDP growth came in at 6.5% driven by private consumption, Govt spending, Growth accommodative RBI Monetary Policy, Lower Current Account Deficit, Above Normal Monsoon & Lower Inflation.

India’s long-term story intact, while near term concerns have risen and could weigh on investor sentiments, medium to long term India story remains intact driven by the following:

– INDIA’s MACROS REMAIN ROBUST (Fiscal consolidation, Strong Balance Sheets, Recovery in

Consumption etc.) amidst slowing global growth.

– India’s long-term growth prospects steady, projected at 6.5% real GDP growth and 10-11%

nominal GDP growth.

– STRONG BALANCE SHEETS: The strength of bank (NPAs below 1%) and corporate balance

sheets is notable. India Inc.’s profits are not only growing strong, but they are also

generating large amounts of free cashflows ‒ in sharp contrast to 2003-2008, where free

cashflows were in deficit.

– Household debt levels are also reasonable compared to global standards. India’s

Aggregate debt to GDP is lower than in 2010, while it has risen globally

KEY FACTORS TO WATCH OUT IN 2025 ARE:

– Trade Negotiations & Eventual Tariffs

– Geopolitical tensions

– Oil prices

– Progress of Monsoon

– Revival in Consumption

– Credit Growth Revival

– Real Estate Upcycle

– Flows

– Valuation

– Corporate Earnings

Our Recommendation is to go overweight with Flexi Cap for long term, BFSI and Consumption as preferred sectors and Hybrid Funds for 2 – 3 years’ time frame.

CALL US: 78100 79946, for Recommendation and to review your Portfolio Reviews

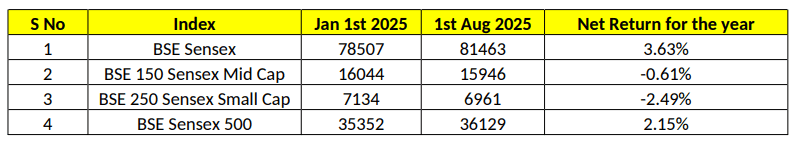

Weekly Market Pulse

Domestic equity markets declined for the fourth consecutive week, with key benchmark indices BSE Sensex falling by 0.87% on Friday. The longest losing streak in over two years

The fall was broad-based as the mid-cap segment and the small cap segment

both closed the week in the red.

Domestic equity markets declined when U.S. Imposed 25% import tariffs on India, escalating geopolitical tension and investor anxiety.

There are Earnings Impact & mixed Q1 Results, Valuation and Credit Concerns

Foreign institutional investors (FIIs) sold ₹25,000 crore in just 8 days, marking one of the steepest capital outflows in recent months

Mixed Q1 earnings: Especially from IT, Pharma, Auto & Financials, triggering sell-offs in heavyweight stocks

Bajaj Finance, Kotak Mahindra Bank, Wipro dropped 3–7% on earnings concerns.

Sun Pharma, Dr. Reddy’s, Cipla saw steep losses despite being defensive

names

The Indian Rupee fell ~1.2%, ending the week at ₹87.54/USD, reacting to tariff fears and FII outflows

The VIX index rose ~3%, indicating elevated volatility sentiment among

investors

Mutual Fund Corner

Invesco India Multicap Fund

Invesco Multicap Fund that invests in stocks across Market Capitalisation and consistently explore opportunities in Large, Mid and Small Cap Space.

Why to Invest in Invesco Multicap Fund?

1. The fund adopts a diversified approach and invests across large, mid and small cap companies.

2. Emphasis on bottom up approach to select stocks across the market capitalization range with focus on long term growth with no sector bias.

3. While retaining its flexibility, the fund maintains exposure in the range Large cap companies : 25% – 50% , Midcap & Small cap companies : 50% – 75%

4. The fund will hold around 50 to 70 stocks

5. The fund objective is to construct a portfolio potential long term capital appreciation and can weather multiple market cycles

6. Investors who are looking at long term opportunities can explore this fund without any bias

To Invest In SIP & In Mutual Funds Click The Link & Start Your Investments Instantly

( You Can Also Call Us @ 78100 79946 )

Mutual Fund Course

All you want to learn about Mutual Funds

Kickstart your Investment Journey of 2025 from here

What You will Learn:

1. A-Z of Mutual Funds

2. Master the Art of SIP’s

3. Build Wealth Like a Pro

4. Recorded session contains 8 Chapters in Tamil Language

5. Lifetime Access

Top 10 Mutual Fund Products

Is your Mutual Fund Portfolio giving less returns?

Rebalance your Portfolio with High Performing Mutual Funds

Power up your Portfolio with Top 10 Best performing Mutual Funds of 2025

Click the below link to purchase for Rs. 999/-

Stock Simplified Course

All you want to learn about Stock Market

Kickstart your Investment Journey of 2025 from here

Key Highlights:

1. Key entry and exit points of the stock market

2. 6-point filter to select a high-performing stock

3. Learn macro-economic trends in stock picking

This Week Media Publications

This Week at Nanayam Vikatan.

“Why do you need a Good Financial Advisor and how

to identify a Financial Advisor?”

Quote for the Week!

In Wealth Creation, many try to rush their way to thetop — Chasing

Speculations with greedy hacks. But real growth & sustainable results.

That takes time, patience, and consistency.

Just like a marathon, not a sprint — SIP in Mutual Funds helps you build a

solid financial future, one step at a time.

Build slow. Build right.

Start small. Stay consistent with Mutual Funds. Start a SIP Now. Let time do

the magic

My Book Publications

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.