Weekly Wealth Report

Issue 192, Weekly Wealth Newsletter: 28th April 2025 – 5th May 2025

(Weekly Wealth Newsletter and a Private Circulation from Creating Wealth Company)

Curated by

Mr. Sathish Kumar

Founder – Creating Wealth Company

Crorepathi Creator | Financial Consultant | Author | Speaker | Columnist | Youtuber

Phone – 9841058689

Mail – creatingwealthadvisory@gmail.com

Web – www.sathishspeaks.com

Worried about India & Pakistan Escalated Conflict?

Download this NewsLetter as a PDF

Markets expect an escalation in India-Pakistan tensions

In the aftermath of the Pahalgam attack that left 26 dead earlier this week, India has launched a series of retaliatory measures targeting Pakistan’s diplomatic and strategic interests, which includes expulsion of Pakistani military attachés, closing the Attari border, and suspending the Indus Waters Treaty.

At the bourses, meanwhile, the Sensex lost over 800 points deals to hit a low of 78,797 levels on Friday. From a level 71,425 on April 7, 2025 on tariff Sensex jumped close to 80,000.

“Investors are nervous due to the developing geopolitical situation with Pakistan after the Pahalgam attack. Markets expect an escalation in the tensions between India and Pakistan, and there is no doubt about this.

Lessons from history

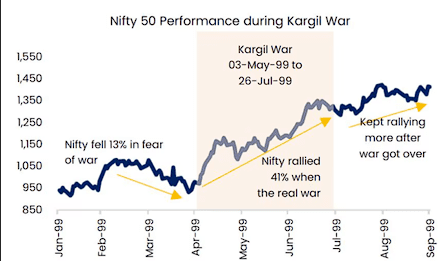

Historically, equity markets have generally seen a knee-jerk reaction on account of geopolitical risks in the near-term, but have found their feet soon.

The Kargil confrontation between India and Pakistan, for instance, saw a sharp market correction in mid-1999. However, the markets rallied sharply as realisation dwelled that the conflict would not last long.

There is not much need to panic at this stage. A full-fledged war is ruled out, but tensions, the markets feel, between India and Pakistan will rise. The markets should be able to live with that and will eventually bounce back, as seen in the past as well. As an investment strategy, investors should buy the dips from a long-term perspective.

Indian Stock Market currently with combination of Robust Earnings, FII inflows, improving macros (inflation cooling, policy stability), and global tailwinds (such as the softer dollar and Fed pause hopes) have poised for long term growth. The financial sector, particularly private banks and NBFCs, continues to exhibit earnings resilience and strong credit growth, suggesting potential sustainability.

Successful investment strategy requires regular reviewing and investor should buy funds at lower levels you can always reach us @ 78100 79946 for your portfolio review and rebalance

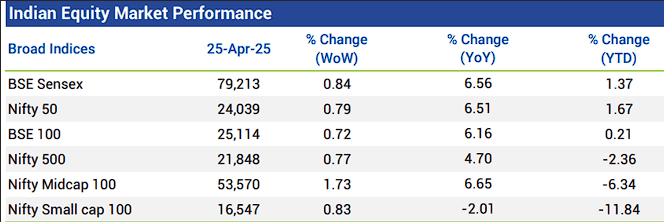

Weekly Market Pulse

Domestic equity markets rose for the second consecutive week as key benchmark indices BSE Sensex and Nifty 50 rose 0.84% and 0.79%, respectively.

The rally was broad-based as the mid-cap segment and the small-cap segment both closed the week in the green.

Domestic equity markets rose as the postponement of U.S. tariffs and newly announced exemptions on certain products sparked hopes for possible negotiations that might ease the strain on global trade.

Gains were extended buoyed by expectations of a robust domestic economic outlook.

However, gains were restricted after the recent terrorist attack in Pahalgam, Jammu and Kashmir, and India’s subsequent downgrading of diplomatic relations with Pakistan, including suspending the Indus Waters Treaty

In response, Pakistan closed its airspace to Indian flights and suspended the Shimla Agreement.

On the BSE sectoral front, BSE IT rallied 5.87% after HCL Technologies reported better-than expected Q4 FY25 earnings, with an 8% increase in net profit and $3 billion in new bookings.

Mutual Fund Corner

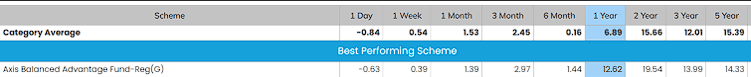

Top Dynamic Balanced Advantage Funds for 2025

Balance Advantage Funds invest in a mix of stocks and FD-like instruments. However, they keep changing this allocation based on the market conditions to provide you optimal returns with minimal risk. Balance Advantage Funds also known as Dynamic Asset Allocation Funds.

Advantages of Dynamic Asset Allocation funds

- Model-based triggers which tell the fund manager adjustments needed to deliver consistent and stable returns

- Books profit when markets rise and invest more when markets correct

- Suitable for an investment horizon of 3+ year

To invest in SIP & in Mutual Funds Click the link and start your investments instantly

( You can also call us @ 78100 79946 )

Mutual Fund Course

All you want to learn about Mutual Funds

Kickstart your Investment Journey of 2025 from here

What You will Learn:

1. A-Z of Mutual Funds

2. Master the Art of SIP’s

3. Build Wealth Like a Pro

4. Recorded session contains 8 Chapters in Tamil Language

5. Lifetime Access

My First 1 Crore Club

Still Wondering how a salaried person/professionals can make 1cr?

Why do you have to join this Community?

• Having money but still doesn’t know how & where to invest?

• Selecting wrong Stocks?

• Selecting wrong mutual funds?

• Invested in all possible ways still money haven’t doubled?

Join our First 1cr Club Webinar by payingjust 499/-

Stock Simplified Course

All you want to learn about Stock Market

Kickstart your Investment Journey of 2025 from here

Key Highlights:

1. Key entry and exit points of the stock market

2. 6-point filter to select a high-performing stock

3. Learn macro-economic trends in stock picking

This Week Media Publications

My Recent Article @ Nanayam Vikatan – 7 Financial Rules to Multiply your Money. Grab your copy at your Nearest Shop!

My Book Publications

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.