Weekly Wealth Report

Issue 198, Weekly Wealth Newsletter: 23rd June 2025 – 30th June 2025

(Weekly Wealth Newsletter and a Private Circulation from Creating Wealth Company)

Curated by

Mr. Sathish Kumar

Founder – Creating Wealth Company

Crorepathi Creator | Financial Consultant | Author | Speaker | Columnist | Youtuber

Phone – 9841058689

Mail – creatingwealthadvisory@gmail.com

Web – www.sathishspeaks.com

Where To Invest When The Valuations Are Rising?

Download this NewsLetter as a PDF

Where to Invest in Indian Stock market when the long-term average and fair Valuation range of PE is between 19x to 21x and currently the PE is around 22.9

When the market is so obsessed with Momentum, Macro Fundamentals and when the valuations also looks stretched, investors should look out for bottom up Investing. What drives the fundamental investing on the current market is the 20% of the BSE 500 Stocks in which the companies has Strong Cash Flows, Positive Balance Sheet, Clean Corporate Governance and

Attractive Valuations.

Even when the Geo Political Conflicts, Unsettled Trade Tariff’s and Rising oil prices have a strong negative sentiment, investors will continue to see the specific Stock and Sectors are performing amid this news.

Markets are moved by Interest Rate Cycles, Liquidity and Earnings reporting. And all these factors are favouring Current market scenario. Record SIP flows, folios up 2.5x in five years providing enough liquidity.

On sector front Private banking is one space that looks interesting. The energy transition also provides opportunities.

Passenger vehicles are another long-term trend we find compelling due to low penetration levels in India. Companies that can maintain or grow market share in this segment should benefit as penetration increases. Many local companies are also cost-competitive compared to global players, making this an attractive segment.

If you are Mutual Fund Investor, identify portfolio which has higher overweight in sectors like Financial Services, Auto and its Ancillary, Discretionary Consumption & Power.

Invest regularly to take advantage of near term market volatility and you will get benefit from Rupee Cost Averaging.

We recommend increase your Lumpsum and SIP and to Stay Invested for Long Term

Successful Investment Strategy requires Regular Reviewing and Choosing Best Funds. Reach us @ 7810079946 for Your Portfolio Review and Best Performing Mutual Funds

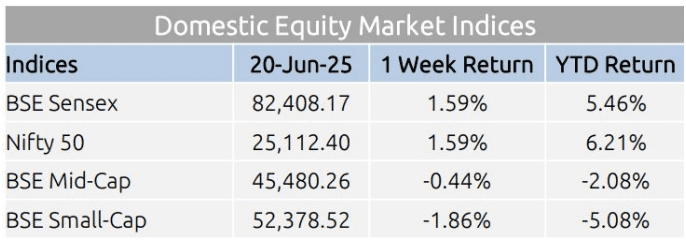

Weekly Market Pulse

Domestic equity markets rose after posting losses in the previous week as key benchmark indices BSE Sensex and Nifty 50 rose 1.59% each. However, the mid-cap segment and the small-cap segment both closed the week in the red.

On the BSE sectoral front, BSE Auto rose 1.17% following reports that India is exploring Australia as an alternative source for rare-earth magnets to reduce reliance on China

BSE Healthcare fell 2.08% after the U.S. President proposed tariffs on imported medicines, posing a major challenge for Indian drugmakers. India’s wholesale price index (WPI)-based inflation eased to 0.39% YoY in May 2025, down from 0.85% in Apr 2025.

India’s merchandise trade deficit narrowed annually to $21.88 billion in May 2025 compared to $22.09 billion in May 2024.

Bond yields climbed as investor sentiment weakened amid a sharp rise in crude oil prices, fuelled by escalating geopolitical tensions stemming from the ongoing conflict between Israel and Iran.

Mutual Fund Corner

Mirae Asset Balanced Advantage Fund

Mirae Balanced Advantage Fund will help investor to capitalise potential

upside on Equities and limit the downside by dynamically managing the

portfolio investment through Equity, Arbitrage, Debt and Money Market

Instruments.

Why to Invest in Mirae Balanced Advantage Fund?

1. Fund follows the fundamental approach to assess equity market

valuations at any point in time and ascertain the necessary desired net

equity for fund

2. The fund therefore endeavours to provide an optimum equity market

participation for Investor.

3. The fund attempts to provide a risk adjusted return experience while

smoothening the volatility by actively managing the net equity position

in the fund

4. The Net Equity and Arbitrage position will help the investor to get

Equity Capital Gains advantage.

To invest in SIP & in Mutual Funds Click the link and start your investments instantly

( You can also call us @ 78100 79946 )

Mutual Fund Course

All you want to learn about Mutual Funds

Kickstart your Investment Journey of 2025 from here

What You will Learn:

1. A-Z of Mutual Funds

2. Master the Art of SIP’s

3. Build Wealth Like a Pro

4. Recorded session contains 8 Chapters in Tamil Language

5. Lifetime Access

Top 10 Mutual Fund Products

Is your Mutual Fund Portfolio giving less returns?

Rebalance your Portfolio with High Performing Mutual Funds

Power up your Portfolio with Top 10 Best performing Mutual Funds of 2025

Click the below link to purchase for Rs. 999/-

Stock Simplified Course

All you want to learn about Stock Market

Kickstart your Investment Journey of 2025 from here

Key Highlights:

1. Key entry and exit points of the stock market

2. 6-point filter to select a high-performing stock

3. Learn macro-economic trends in stock picking

This Week Media Publications

This Week @ Nanayam Vikatan!

How To Budget And Save More With Your Salary?

The Book I'm Reading For The Week

“The Almanack of Naval Ravikant” emphasizes building

wealth and happiness by focusing on specific knowledge,

leverage, and long-term thinking.

Eric Mentions about Ravikant views on Long term focus on

Wealth, Skills and Knowledge creation. Building Mental

Models for Business, Improving Productivity, Scaling up,

Investing and Much More

I was just fascinated and attracted by his personality,

thoughts and wisdom.

My Book Publications

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.