Issue 134, Weekly Wealth Newsletter: 18th Mar 2024 – 25th March 2024

Is your Mutual Fund Portfolio Underperforming?

Call us @ 63795 18807 to Review your Mutual Fund Portfolio

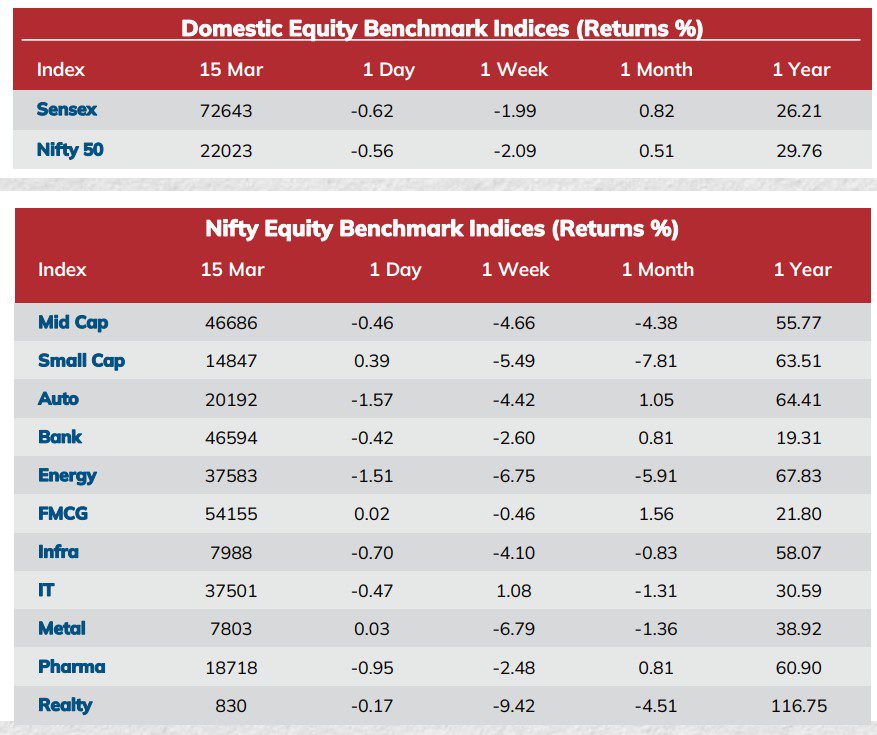

Weekly Market Update

- Indian equities ended lower on Friday because of weak global cues. There are concerns on Federal Reserve Rate cut timing and hotter than expected US Inflation data.

- Finance minister Nirmala Sitharaman said despite huge fluctuations globally, the Indian stock market has maintained "a certain level of sanity" and the market should be allowed to play on its own

- Indian Q3 GDP Growth at 8.4% beats market expectation and estimates

- Indian Economy grows at fastest pace in 6 Quarters

- Retail inflation for February remains almost unchanged at 5.09%

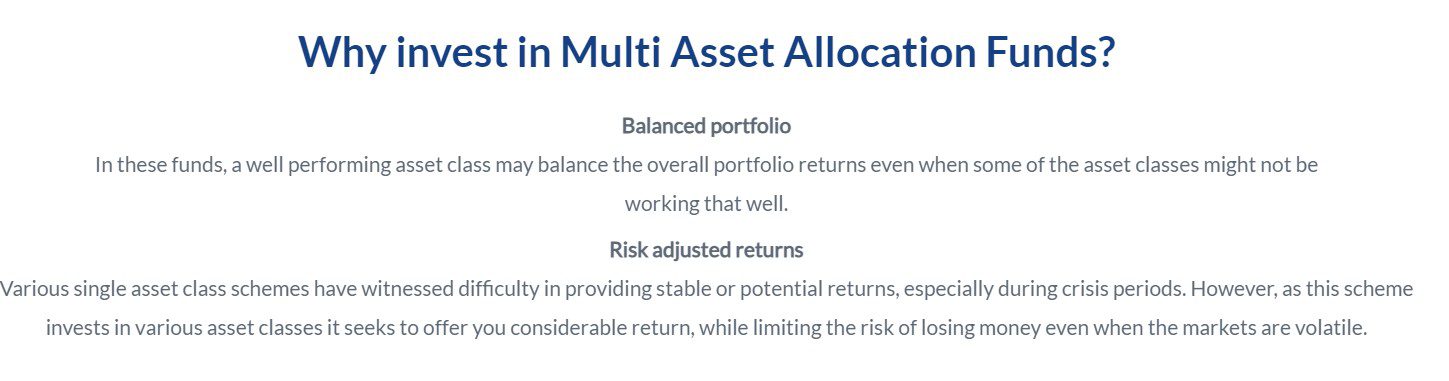

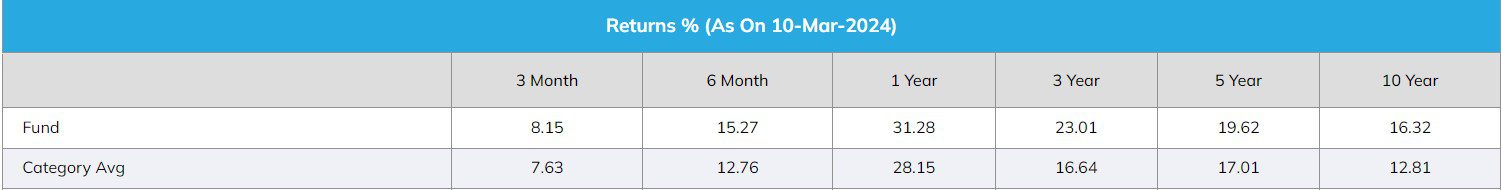

Mutual Fund Corner

ICICI Pru Multi Asset Fund

Stock of the Week

ITD Cementation

CMP – 306

Target – 385 ( In 12 – 18 Months Time Frame)

For your Equity recommendation – open a De Mat account with Angel Broking with this link

This week Media Publications

Middle Class to Million Dollar Book

To Buy my Untold Wealth Secret Book from Flipkart

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.