Weekly Wealth Report

April 22, 2024

(Weekly Wealth Newsletter and a Private Circulation from Creating Wealth Company)

Curated by

Mr. Sathish Kumar

Founder – Creating Wealth Company

Crorepathi Creator | Financial Consultant | Author | Speaker | Columnist | Youtuber

Phone – 9841058689

Mail – creatingwealthadvisory@gmail.com

Web – www.sathishspeaks.com

Issue 139, Weekly Wealth Newsletter: 22nd Apr 2024 – 29th Apr 2024

What is your Mutual Fund Portfolio Overlap Percentage?

This happens because their underlying portfolio of these two schemes have a high portfolio Overlap.

Such a high portfolio overlap reduces diversifications, which is why investors should try and avoid such overlap.

An equity mutual funds portfolio built by investing in mix of stocks depending on the fund’s objective. An investor should check his categories of Mutual Funds before he constructs his portfolio, so that he will get different set of stocks and his portfolio is diversified.

However, it is impossible to eliminate the portfolio overlap as there are stocks common across all categories and schemes.

As an investor, your mutual fund portfolio should never exceed 30 – 40% of such portfolio overlap.

Call us @ 63795 18807 to Handpick High Performing Funds and Stocks for your Portfolio

Weekly Market Update

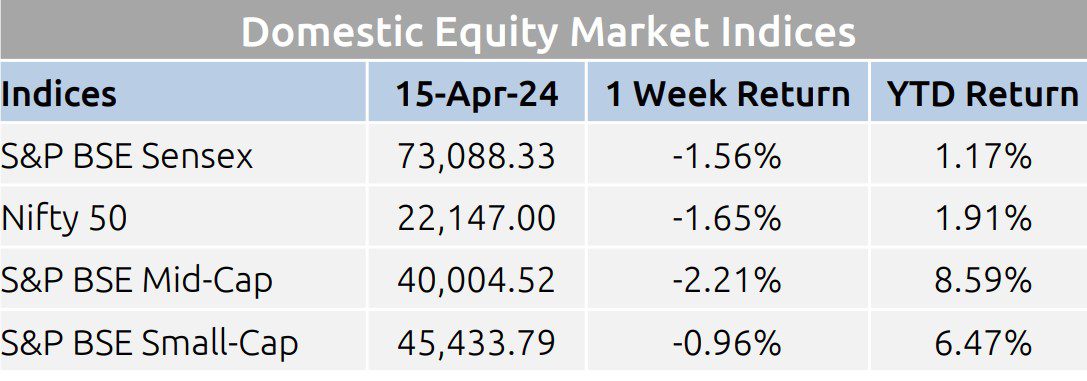

Domestic equity markets fell during the week as key benchmark indices S&P BSE Sensex and Nifty 50 fell 1.56% and 1.65%, respectively

The fall was broad based as the mid-cap segment and the small-cap segment both closed the week in red.

Domestic equity markets fell during the week under review as sentiments were dampened after the recent flare-up between Iran and Israel which increased anxiety among the investors over the possibility that this would disrupt the world’s supply of commodities, particularly crude oil and some industrial metals.

On the BSE sectoral front, S&P BSE IT plunged 4.59% amid growing concerns that the U.S. Fed may not start cutting rates this year which could impact economic recovery and push clients to curtail their discretionary spending on IT services.

S&P BSE Realty fell 2.79% after data showed that private equity funding in the real estate sector fell 16% in FY24 to USD 3.67 billion on lower interest from foreign investors.

Bond yields rose on worries over the heightened conflict in the Middle East.

Yield on the 10-year benchmark paper (7.18% GS 2033) rose by 5 bps to close at 7.23% from the previous week’s close of 7.18%.

Mutual Fund Corner

ICICI Multi Asset Fund

‘Don’t put all your eggs in one basket’ is perhaps the most popular adage in financial planning.

With the Indian equity market reaching new all-time highs, investors are now seeking to diversify their portfolios beyond equities, considering assets like debt and gold.

Multi Asset Allocation : The fund has 66.82% investment in domestic equities of which 47.22% is in Large Cap stocks, 5.86% is in Mid Cap stocks, 2.55% in Small Cap stocks. The fund has 12.03% investment in Debt, of which 6.91% in Mutual Fund - Fund of Funds, 4.45% is in Low Risk securities.

Winners Rotate, hence jack of all trade should be part of your portfolio to minimise your RISK and optimize your returns.

Stock of the Week

TCS

CMP – 3839

Target – 4599 ( In 12 – 18 Month’s Time Frame)

For your Equity recommendation – open a De Mat account with Angel Broking with this link

This week Media Publications

Middle Class to Million Dollar Book

Man and his struggle to generate and preserve wealth is eternal. One thing which is common among everyone in this society, that everyone has financial dream and aspiration to become Crorepati.

Middle Class to Million Dollar is a guide to understand how simple and common sense in Personal Finance can help you to get wealthy Corpus.

Click here to purchase the book from Amazon

To Buy my Untold Wealth Secret Book from Flipkart

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.