Weekly Wealth Report

April 29, 2024

(Weekly Wealth Newsletter and a Private Circulation from Creating Wealth Company)

Curated by

Mr. Sathish Kumar

Founder – Creating Wealth Company

Crorepathi Creator | Financial Consultant | Author | Speaker | Columnist | Youtuber

Phone – 9841058689

Mail – creatingwealthadvisory@gmail.com

Web – www.sathishspeaks.com

Issue 140, Weekly Wealth Newsletter: 29th Apr 2024 – 6th May 2024

Will Sensex hit 1,50,000 by 2029?

Sensex touched 75,000 where do we go from here? This question can be answered in multiple ways. First, the doubling of Sensex from 37,500 to 75,000 happened in just under five years.

The sceptic is bound to question, it's one thing to double from 37,500 to 75,000 in five years. But can this repeat on a significantly higher base?

Pre-Covid, the number of new demat accounts opened was an average of 3,50,000 per month. The current demat monthly addition run rate is over 3 million. Total demat accounts have exploded from 40 million in March 2020 to 150 million today. Monthly mutual fund SIP inflows have shot up from ₹8,000 crore five years back to ₹19,000 crore now.

This retail equity boom is doing a couple of things. One, in the primary market, it is flooding the Indian corporate sector with liquidity to be invested for growth. Two, the boom in the secondary market is translating into wealth-effect-led consumption, further supporting GDP growth.

In sum, who precisely knows the future? But there is a good probability that the equity market's 15% compounding of the last 45 years may well sustain into the next 5 years. Stay invested, so that you don't miss out on this ultimate compounding machine called Sensex.

Call us @ 63795 18807 to Handpick High Performing Funds and Stocks for your Portfolio

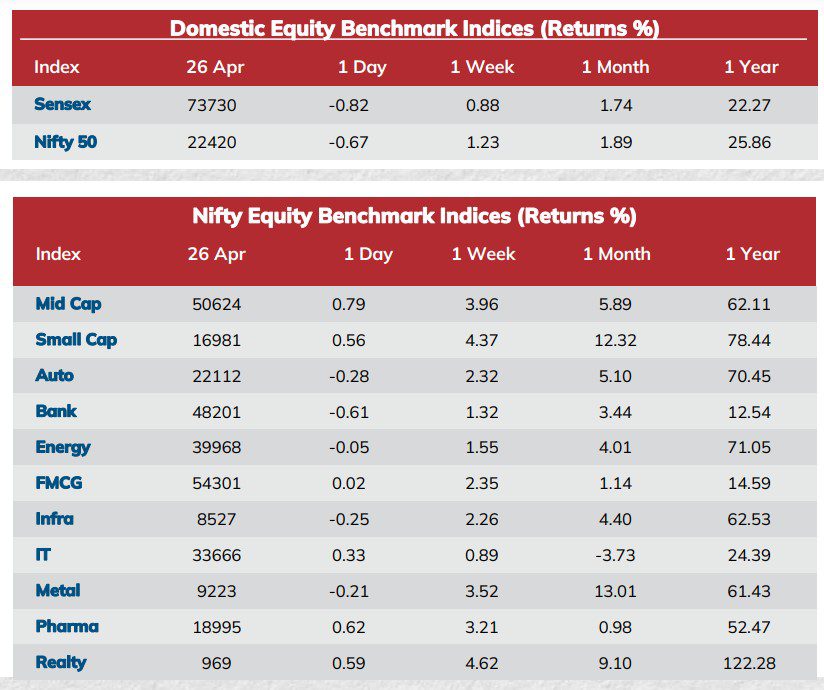

Weekly Market Update

- Indian equities snapped their five-day winning streak on Friday, after dismal earnings update by a domestic non-banking finance company dragged the financial sector shares down.

- On Friday, the Indian stock market indices ended sharply lower, snapping their five-day winning streak, sensex declined 609.28 points, or 0.82%, to close at 73,730.16, while the Nifty 50 settled 150.40 points, or 0.67%, lower at 22,419.95.

- Investors will eye several stock market triggers this week including the Q4 results, auto sales data, domestic and global macroeconomic data, US Federal Reserve’s interest rate decision, Israel-Iran conflict, crude oil prices, and other global market cues.

- We expect market momentum to resume with a focus on stock-specific action due to the ongoing result season and sector rotation at play

Mutual Fund Corner

ICICI Multi Asset Fund

‘Don’t put all your eggs in one basket’ is perhaps the most popular adage in financial planning

With the Indian equity market reaching new all-time highs, investors are now seeking to diversify their portfolios beyond equities, considering assets like debt and gold.

Multi Asset Allocation : The fund has 66.82% investment in domestic equities of which 47.22% is in Large Cap stocks, 5.86% is in Mid Cap stocks, 2.55% in Small Cap stocks. The fund has 12.03% investment in Debt, of which 6.91% in Mutual Fund - Fund of Funds, 4.45% is in Low Risk securities.

Winners Rotate, hence jack of all trade should be part of your portfolio to minimise your RISK and optimize your returns.

Stock of the Week

Tata Motors

CMP – 1000

Target – 1199 ( In 12 – 18 Month’s Time Frame)

For your Equity recommendation – open a De Mat account with Angel Broking with this link

This week Media Publications

Middle Class to Million Dollar Book

Man and his struggle to generate and preserve wealth is eternal. One thing which is common among everyone in this society, that everyone has financial dream and aspiration to become Crorepati.

Middle Class to Million Dollar is a guide to understand how simple and common sense in Personal Finance can help you to get wealthy Corpus.

Click here to purchase the book from Amazon

To Buy my Untold Wealth Secret Book from Flipkart

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.