Weekly Wealth Report

6th May 2024

(Weekly Wealth Newsletter and a Private Circulation from Creating Wealth Company)

Curated by

Mr. Sathish Kumar

Founder – Creating Wealth Company

Crorepathi Creator | Financial Consultant | Author | Speaker | Columnist | Youtuber

Phone – 9841058689

Mail – creatingwealthadvisory@gmail.com

Web – www.sathishspeaks.com

Issue 141, Weekly Wealth Newsletter: 6th May 2024 – 13th May 2024

Have you Calculated Rolling Returns in your Mutual Fund Portfolio?

Trailing returns have a recency bias and point-to-point returns are specific to the period taken for analysis. But, rolling return measures the fund's absolute and relative performance across all time-periods without any bias.

Why Rolling Returns Matter’s?

- Capturing Market Cycles- Rolling returns help investors account for the cyclical nature of markets. A fund might perform exceptionally well in one period and poorly in another. Rolling returns provide insights into the overall fund performance across different market phases.

- Consistency Assessment- By calculating rolling returns, you can assess a fund's consistency in delivering returns. A high rolling return indicates that the fund has consistently performed well over various time frames.

- Accurate and unbiased- Absolute returns might provide misleading information if they're calculated during periods of market extremes. Rolling returns offer a more balanced perspective, reducing the impact of extreme market conditions.

Call us @ 63795 18807 to Handpick High Performing Funds and Stocks for your Portfolio

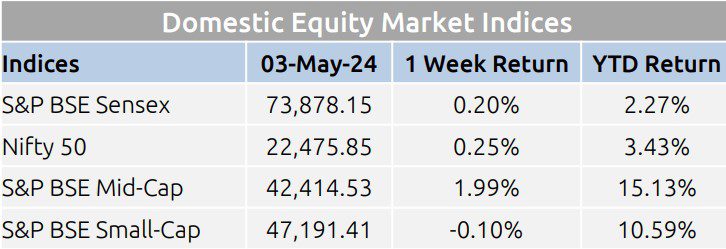

Weekly Market Update

- Domestic equity markets closed with little change after witnessing rise for three consecutive weeks as key benchmark indices S&P BSE Sensex fell marginally and Nifty 50 rose 0.03%.

- The mid-cap segment closed the week in green, however, the small-cap segment closed the week in red.

- Domestic equity markets rose as optimism increased as a result of increased efforts to mediate a ceasefire between Israel and Hamas that reduced geopolitical tensions.

- S&P BSE Auto rose 2.42% after major automakers reported higher sales of cars and two-wheelers in Apr 2024 from a year earlier.

- Yield on the 10-year benchmark paper (7.18% GS 2033) fell by 4 bps to close at 7.15% from the previous week’s close of 7.19%.

- The Manufacturing Purchasing Managers’ Index eased slightly to 58.8 in Apr 2024 compared to 59.1 in Mar 2024 bolstered by strong demand conditions which resulted in a further expansion of output.

Mutual Fund Corner

HDFC Manufacturing Fund - NFO

HDFC Mutual Fund is launching NFO under its “Thematic Fund”, named as HDFC Manufacturing Fund.

Manufacturing is the Driving Force behind the GDP in coming years will be and it’s playing a major role with.

1. India’s Holistic Growth in Coming Years

2. Macro-economic Stability

3. Job Creations and Large-Scale Employment before 2030

4. Foreign Currency inflow

5. To maintain Current Account Balance

Investing in manufacturing, while promising, but requires caution due to its cyclical nature and external dependencies, advising investors to allocate only a portion of their portfolio to this sector for diversification

Stock of the Week

Manappuram Finance

CMP – 193

Target – 240 ( In 12 – 18 Month’s Time Frame)

For your Equity recommendation – open a De Mat account with Angel Broking with this link

https://app.aliceblueonline.com/openAccount.aspx?C=SSP03

This week Media Publications

Middle Class to Million Dollar Book

Man and his struggle to generate and preserve wealth is eternal. One thing which is common among everyone in this society, that everyone has financial dream and aspiration to become Crorepati.

Middle Class to Million Dollar is a guide to understand how simple and common sense in Personal Finance can help you to get wealthy Corpus.

Click here to purchase the book from Amazon

To Buy my Untold Wealth Secret Book from Flipkart

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.