Weekly Wealth Report

13th May 2024

(Weekly Wealth Newsletter and a Private Circulation from Creating Wealth Company)

Curated by

Mr. Sathish Kumar

Founder – Creating Wealth Company

Crorepathi Creator | Financial Consultant | Author | Speaker | Columnist | Youtuber

Phone – 9841058689

Mail – creatingwealthadvisory@gmail.com

Web – www.sathishspeaks.com

Issue 142, Weekly Wealth Newsletter: 13th May 2024 – 20th May 2024

Manufacturing Mutual Funds are shining, Are they worthy for Investment Portfolio?

And with India steadily climbing the ranks as a global manufacturing powerhouse, mutual funds focusing on the manufacturing segment have performed well. The manufacturing sector holds immense potential as a catalyst for economic growth, social development, and job creation.

Undoubtedly with India steadily climbing the ranks as a global manufacturing powerhouse, mutual funds focusing on the manufacturing segment have performed well. The manufacturing sector holds immense potential as a catalyst for economic growth, social development, and job creation.

Manufacturing is an emerging and promising theme, but due to its diversification nature, most of the investors already has 60% exposure towards Manufacturing. Pls check your portfolio and do an analysis and invest with Manufacturing Funds.

Call us @ 63795 18807 to Handpick High Performing Funds and Stocks for your Portfolio

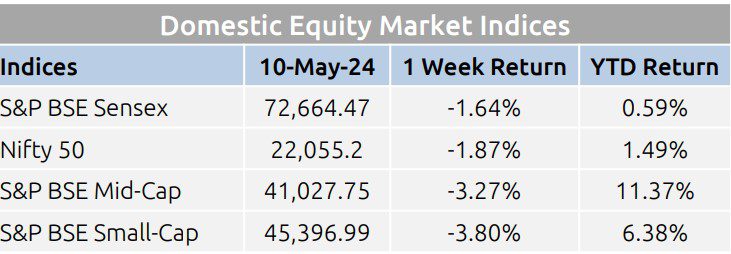

Weekly Market Update

- Domestic equity markets fell after witnessing rise in previous two weeks as key benchmark indices S&P BSE Sensex and Nifty 50 fell 1.64% and 1.87%, respectively.

- The fall was broad based as the mid-cap segment and the small-cap segment both closed the week in red.

- Losses were extended on concern over the unpredictability surrounding the outcome of the ongoing general election and due to decreased voter turnout. Sentiments were further affected by concerns over delays in rate cuts by the U.S. Federal Reserve.

- On the BSE sectoral front, S&P BSE PSU experienced 4.84% fall on concerns over election-related uncertainty.

- India’s Services Purchasing Managers’ Index (PMI) eased slightly to 60.8 in Apr 2024 as compared to 61.2 in Mar 2024 but saw the fastest growth rates in 14 years. Growth was driven by significant rise in new orders, with a notable strength in domestic demand.

- Industrial production growth in India (IIP) slowed to 4.9% YoY in Mar 2024, as compared to 5.6% rise in Feb 2024. Production in the manufacturing industry increased by 5.2%, mining by 1.2% and electricity by 8.6% in Mar 2024.

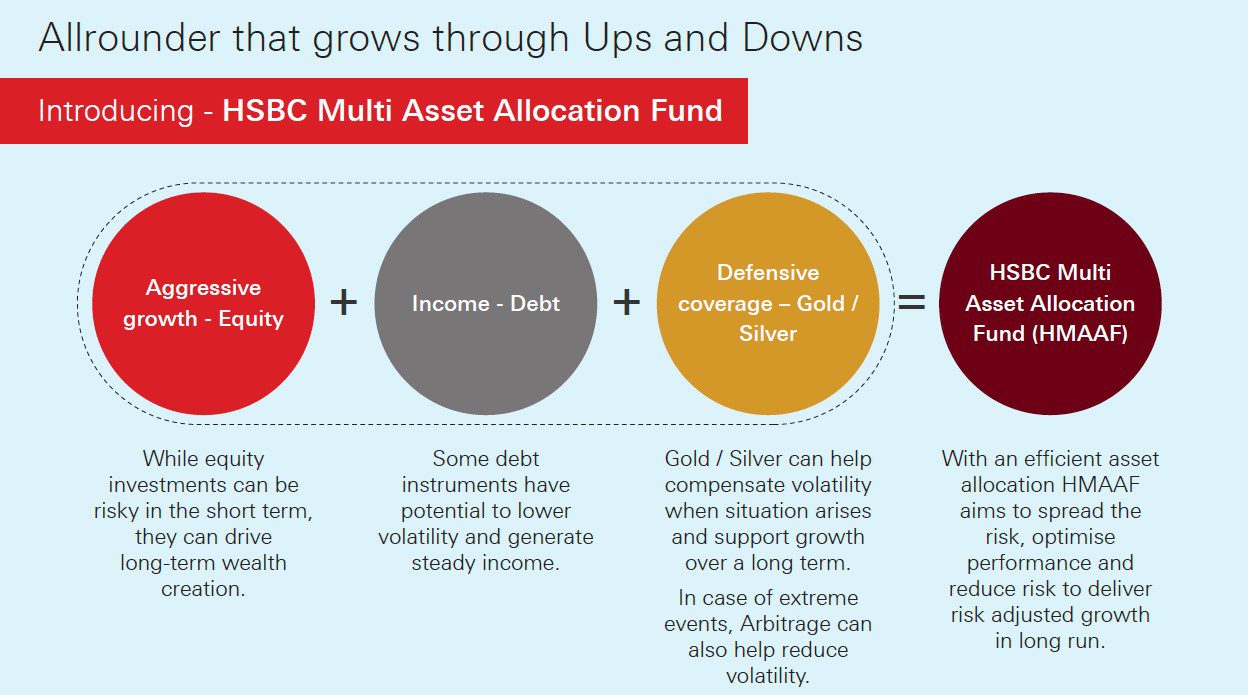

Mutual Fund Corner

HSBC Multi Asset Fund

Every portfolio needs different asset classes that can combine to provide return potential while adjusting risk. Choose a fund that invests in equity for growth potential while debt and Gold / Silver can help to balance risks in volatile market conditions.

Multi Asset Funds are best pick for Risk Adjusted Performances

Stock of the Week

Axis Bank

CMP – 1109

Target – 1399 ( In 12 – 18 Month’s Time Frame)

For your Equity recommendation – open a De Mat account with Angel Broking with this link

https://app.aliceblueonline.com/openAccount.aspx?C=SSP03

This week Media Publications

At this week Nanayam Vikatan – How to manage money between Married Couples? Pick up your copy, magazine is at your nearest stands.

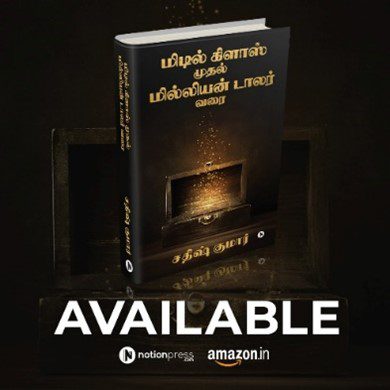

Middle Class to Million Dollar Book

Man and his struggle to generate and preserve wealth is eternal. One thing which is common among everyone in this society, that everyone has financial dream and aspiration to become Crorepati.

Middle Class to Million Dollar is a guide to understand how simple and common sense in Personal Finance can help you to get wealthy Corpus.

Click here to purchase the book from Amazon

To Buy my Untold Wealth Secret Book from Flipkart

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.