Weekly Wealth Report

April 8, 2024

(Weekly Wealth Newsletter and a Private Circulation from Creating Wealth Company)

Curated by

Mr. Sathish Kumar

Founder – Creating Wealth Company

Crorepathi Creator | Financial Consultant | Author | Speaker | Columnist | Youtuber

Phone – 9841058689

Mail – creatingwealthadvisory@gmail.com

Web – www.sathishspeaks.com

Issue 137, Weekly Wealth Newsletter: 8 th Apr 2024 – 15th Apr 2024

Where to Invest, when the market is at 52 week’s High?

As we know, equity as an asset class can deliver best returns, but when you foresee volatility in short term, especially when elections are at the corner. What are the options for an investor?

Multi-asset funds, which invests in a blend of Equity, Debt, Gold, Real Estate and International Funds may be suitable for investors with a modest risk appetite and even for seasoned players in the market as a healthy mix of assets would be desirable at present times for both beginner and for Seasoner Investor

Multi-asset allocation funds offer diversification across different asset classes and active management, which can be attractive to investors. Most Multi Asset funds exceed Equity Long term Average return of 12% and its about the time for you to review and rebalance your Portfolio

Call us @ 63795 18807 to Review your Mutual Funds & Stock Portfolio

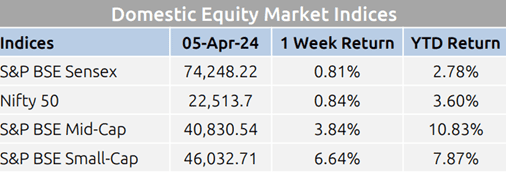

Weekly Market Update

Mutual Fund Corner

What are multi-allocation funds? Why are they popular? Should you invest?

Don’t put all your eggs in one basket’ is perhaps the most popular adage in financial planning

With the Indian equity market reaching new all-time highs, investors are now seeking to diversify their portfolios beyond equities, considering assets like debt and gold.

Multi-Asset Funds offer a solution by automatically rebalancing allocations, ensuring timely adjustments to maintain a balanced investment approach. This proactive approach helps investors navigate changing market dynamics while optimizing their asset mix.

Winners Rotate, hence jack of all trade should be part of your portfolio to minimise your RISK and optimize your returns.

Stock of the Week

Natco Pharma

CMP – 997

Target – 1199 ( In 12 – 18 Month’s Time Frame)

For your Equity recommendation – open a De Mat account with Angel Broking with this link

This week Media Publications

Middle Class to Million Dollar Book

Man and his struggle to generate and preserve wealth is eternal. One thing which is common among everyone in this society, that everyone has financial dream and aspiration to become Crorepati.

Middle Class to Million Dollar is a guide to understand how simple and common sense in Personal Finance can help you to get wealthy Corpus.

Click here to purchase the book from Amazon

To Buy my Untold Wealth Secret Book from Flipkart

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.