Issue 136, Weekly Wealth Newsletter: 1st Apr 2024 – 8th Apr 2024

Happy Financial Year 24 – 25. May this Financial Year bring to you More Success and Prosperity

Market Outlook - What holds Equity Market in Apr 2024

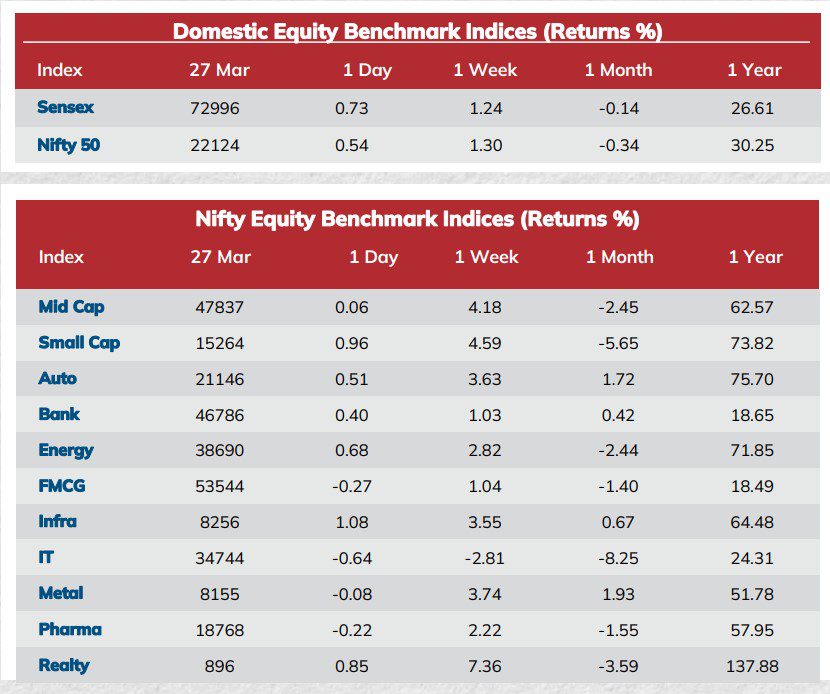

In fact, after the strong outperformance of mid and small-cap categories over large-caps over the last few years, a partial reversal was seen in March. Stress tests by SEBI on midcap and small-cap funds

- In the near-term, market is expected to enjoy the benefit of global liquidity and favourable macro-economic conditions

- Over the medium-term, global macros like US economy and Fed actions could define liquidity movements and equity markets

- Mid and small cap stocks continue to trade at full valuations despite the recent correction in March. While large caps are not necessarily cheap, there are select pockets wherein risk-reward appears more favourable as compared to mid and small caps

Call us @ 63795 18807 to Review your Mutual Funds & Stock Portfolio

Weekly Market Update

Mutual Fund Corner

Why Flexi Cap Mutual Funds are Popular Among Investors?

Flexi-cap schemes offer the flexibility to adjust allocations based on current market conditions and emerging opportunities.

Many investors prefer that the fund manager decide the allocation of their funds among large, mid, and small-cap stocks based on market opportunity.

In the case of a flexi-cap fund, the fund manager doesn’t have any limitations in terms of choosing stocks for investment belonging to any particular sector, market capitalization, or geography. A flexi-cap mutual fund scheme gives you the advantage of having a diversified equity portfolio spanning across large, mid, and small-cap stocks with a single scheme. The fund manager can also allot a certain percentage of the portfolio to international stocks. If you invest in the best flexi-cap mutual fund, it has the potential to give you inflation-beating high returns and thus create wealth for you.

Stock of the Week

Ujjivan Small Finance Bank

CMP – 44

Target – 56 ( In 12 – 18 Month’s Time Frame)

For your Equity recommendation – open a De Mat account with Angel Broking with this link

Middle Class to Million Dollar Book

Man and his struggle to generate and preserve wealth is eternal. One thing which is common among everyone in this society, that everyone has financial dream and aspiration to become Crorepati.

Middle Class to Million Dollar is a guide to understand how simple and common sense in Personal Finance can help you to get wealthy Corpus.

Click here to purchase the book from Amazon

To Buy my Untold Wealth Secret Book from Flipkart

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.