Weekly Wealth Report

(Weekly Wealth Newsletter and a Private Circulation from Creating Wealth Company)

Curated by

Mr. Sathish Kumar

Founder – Creating Wealth Company

Crorepathi Creator | Financial Consultant | Author | Speaker | Columnist | Youtuber

Phone – 9841058689

Mail – creatingwealthadvisory@gmail.com

Web – www.sathishspeaks.com

Issue 146, Weekly Wealth Newsletter: 10th June 2024 – 17th June 2024

Will PM Modi’s 3.0 Economic Agenda move Sensex to 1,00,000?

Investors expect Finance Ministry to carry out Disinvestment, Rationalisation of GST, Regulating Crypto, Sustain Inflation, Revive Farm Sector.

Commerce & Industry to accelerate and deepen services export and to continue PLI incentive to spur Foreign Investments

Our India’s Infrastructure is fast pacing and investors expect the same to continue and develop NH construction with quality and timely completion.

Railways is expected to increase the capacity to move cargo and more passengers. Expediting Vande Bharat and Amrit Bharat are in focus.

Power Industry to bring in new private players for improved service

Electronics & IT is expected to kick start with new ministries and dominating scale in Laptop & Mobile Manufacturing

Call us @ 63795 18807 to Handpick High Performing Funds and Stocks for your Portfolio

Weekly Market Update

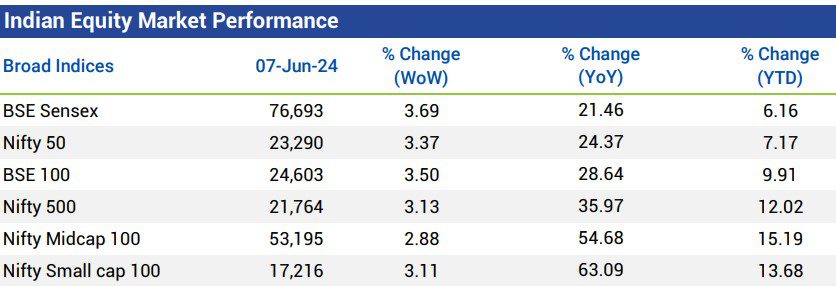

- Domestic equity markets rose after witnessing fall in the previous week as key benchmark indices BSE Sensex and Nifty 50 rose 3.69% and 3.37%, respectively. The rally was broad based as the mid-cap segment and the small-cap segment both closed the week in green.

- Domestic equity markets started the week on higher note in the wake of an optimistic election outcome following the exit poll results which indicated a strong majority in favor of the incumbent party alliance at the Centre

- There was also some cheer on the economic front as government data revealed that India’s GDP growth surpassed all expectations and stood at 7.8% in the fourth quarter of FY24.

- Domestic equity markets rebounded sharply as investors absorbed the Lok Sabha election results and shifted their focus to fundamentals and developments around government formation. Gains were extended after the RBI left the repo rate unchanged at 6.50% and revised the GDP growth rate of domestic economy upward to 7.2% from 7.0% for FY25.

- The RBI projected real GDP growth for 2024-25 at 7.2% with Q1 at 7.3%, Q2 at 7.2%, Q3 at 7.3%, and Q4 at 7.2%, with the risks are evenly balanced.

- The Manufacturing Purchasing Managers’ Index eased slightly to 57.5 in May 2024 compared to 58.8 in Apr 2024

Mutual Fund Corner

Upcoming NFO’s on the Rising Market

Mutual Fund companies will never cease to introduce NFO’s, especially when the sentiments are positive and when the Stock Markert is at Life Time High.

- Sundaram Business Cycle Fund

- Helios Financial Services Fund

- Mahindra Manulife Manufacturing Fund

- Motilal Oswal Multi Cap Fund

- JM Small Cap Fund

But is it worth adding new funds to your existing portfolio?

It is best to continue with the existing schemes for your surplus, because

NFO’s has the risk of Market Timing, No Novel Ideas, No differentiation and of course No Past Performance Track record.

Stock of the Week

Natco Pharma

CMP – 1113

Target – 1399 ( In 12 – 18 Month’s Time Frame)

For your Equity recommendation – open a De Mat account with Angel Broking with this link

https://app.aliceblueonline.com/openAccount.aspx?C=SSP03

Middle Class to Million Dollar Book

Man and his struggle to generate and preserve wealth is eternal. One thing which is common among everyone in this society, that everyone has financial dream and aspiration to become Crorepati.

Middle Class to Million Dollar is a guide to understand how simple and common sense in Personal Finance can help you to get wealthy Corpus.

Click here to purchase the book from Amazon

To Buy my Untold Wealth Secret Book from Flipkart

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.